By Harry Brelsford

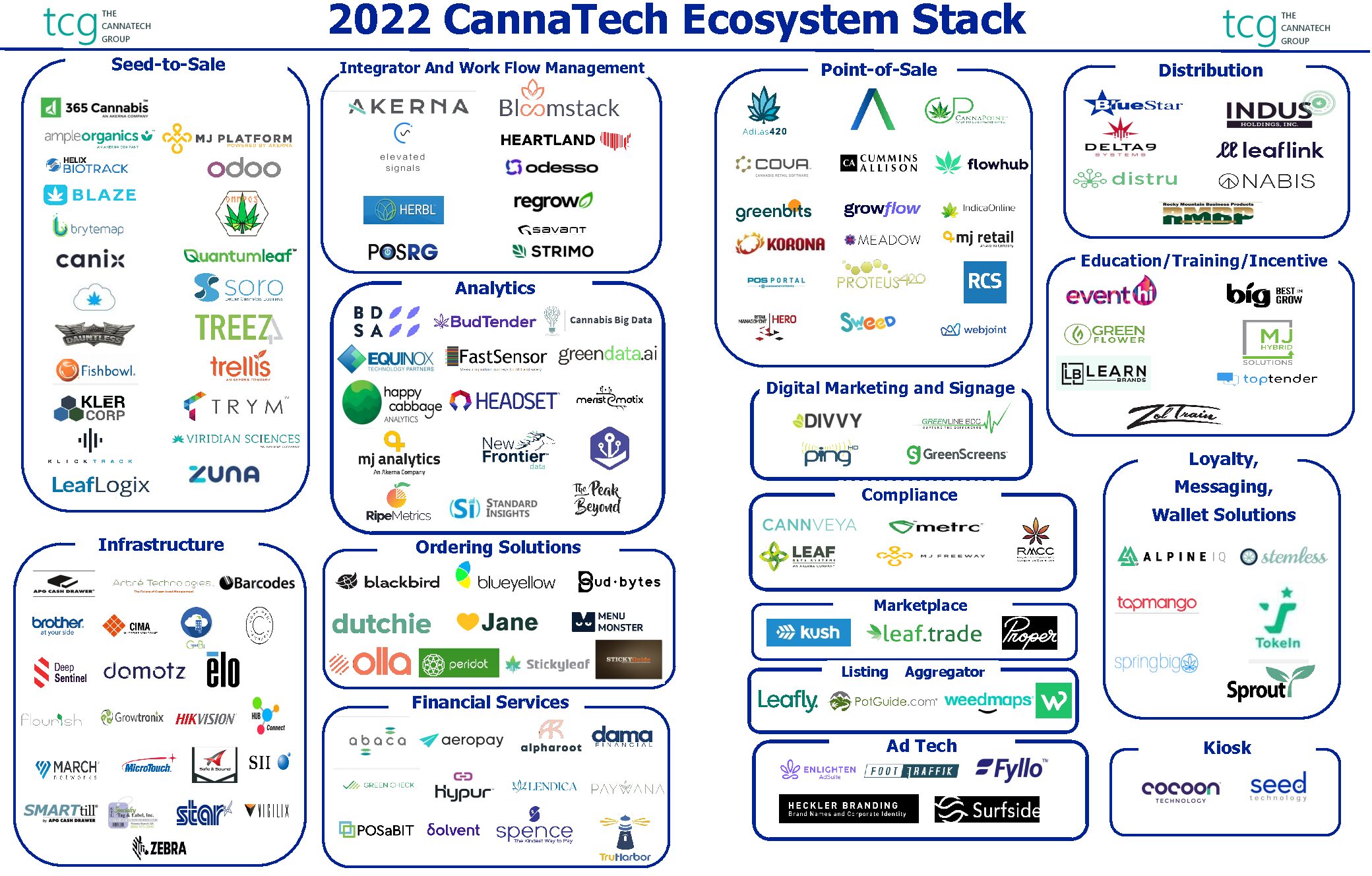

One of the logos on the 2022 CannaTech Ecosystem Stack says it best: “onwards and upwards!” That sentiment is clearly reflected in our annual chart representing the majority of the cannabis technology community.

The logos are separated into 15 categories that provide our view of the cannabis technology ecosystem. Companies that have made a firm commitment to the cannabis technology vertical are eligible to be included in the chart. These firms are typically independent software vendors, original equipment manufacturers, distributors or from a few other select categories such as integrators that have intellectual property.

The updated chart on the next page reflects more than 30 changes from its previous iteration, mirroring the expansion and growth of the greater cannabis economy. I will quickly provide three examples of changes that were made to the chart.

– Addition: Cova Software. I recently consulted with Scott Brinker, the editor at Chiefmartec.com, where he maintains a marketing technology chart with more than 8,000 logos. He told me to expect “hand raisers” that will reach out to me to have their logos included on the chart. And that’s exactly what Dayna Van Buskirk, marketing manager at Cova Software did. Cova is now in more than 1,800 dispensaries, so it was added in the point-of-sale category.

– Exit: Soro. Unfortunately, this seed-to-sale solution exited the market in early 2022, due in part to Washington transitioning to an in-house traceability/compliance software (an event known as an externality). Soro CEO Jerry Tindall shared: “I’m announcing with great sadness that my co-founders and I have decided to shut down Soro. Over the last 5 years we’ve had an amazing ride, met many wonderful people, aided over $100 [million] in fledgling cannabis businesses, achieved 20% market-share in WA State, and most importantly became better versions of ourselves personally and professionally. Alas, recent regulatory changes in WA have effectively destroyed our business model. That combined with various personal reasons feels a lot like the universe telling us it’s time to move on to something new.”

– Mergers and Acquisitions: There are two notable examples of M&A that impacted our chart. Akerna continued its acquisition spree and developed new brands, adding several logos to our chart. And Dutchie in March 2020 announced $200 million in new funding and rolled up Greenbits and LeafLogix. However, every entity remained a separate brand so there was no net change to the logo chart.